In the evolving landscape of digital finance, systems that combine automation, accessibility, and legitimacy are rare. Arvith appears to be one of those exceptions. Developed by Indian entrepreneurs and supported by a government initiative, this system has drawn significant attention due to its reported user growth and claims of rapid financial returns. As a financial analyst, I approached Arvith with healthy skepticism and a focus on verifiable fundamentals.

The Structure: A Scalable, Automated Financial Model

Arvith operates on a straightforward investment model: users begin with ₹21,000, after which the system generates and distributes profits automatically on a daily basis. These payouts are processed through integrations with major Indian banks, providing a level of operational transparency that is often lacking in alternative digital finance systems.

The system’s automation architecture is designed for passive engagement. Users do not need to manage trades, navigate technical dashboards, or execute manual withdrawals. Profit transfers are executed in real time, which minimizes friction and reinforces user trust. From an infrastructure standpoint, Arvith’s architecture aligns with modern trends in financial automation, especially those targeting first-time or non-technical investors.

Scale and Adoption: Over 100,000 Indian Users

One of the most compelling data points in Arvith’s favor is its adoption rate. With more than 100,000 users across India, the system has achieved a critical mass that suggests both usability and scalability.

While high adoption does not guarantee long-term sustainability, it does signal confidence among early participants. Network effects are particularly important in systems like Arvith, where user feedback loops and collective trust are core components of growth. The ability to accommodate this scale without widespread technical or payment issues further strengthens its operational credibility.

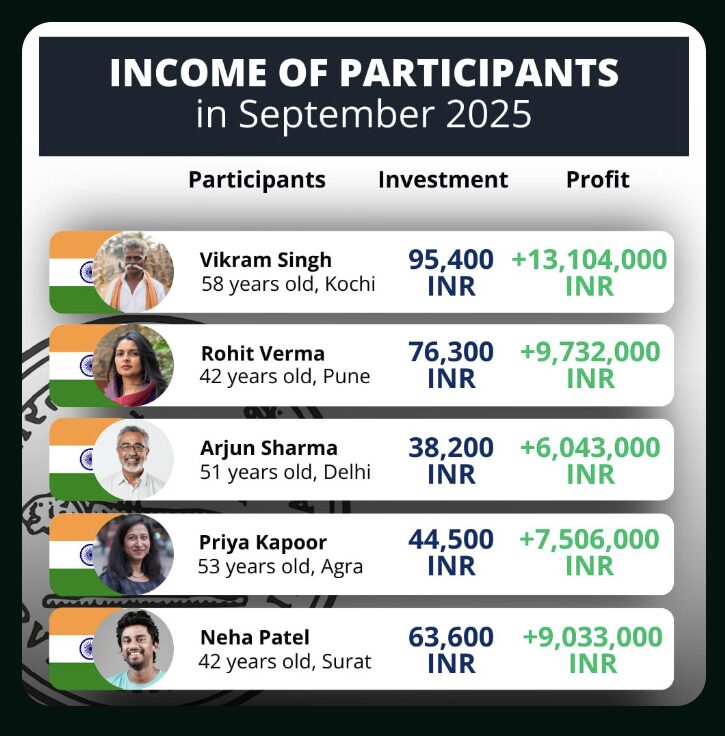

Returns Analysis: ₹10 Lakh in a Month?

The claim that some users have earned over ₹10 lakh in their first month raises legitimate questions. In traditional markets, such returns would imply either significant leverage or extraordinary asset performance. However, Arvith is not structured like a speculative platform.

According to the company, the system generates returns through proprietary algorithms that distribute daily profits across its user base. Without direct access to the back-end financial instruments, it’s difficult to audit the sustainability of these returns. That said, the automated payout system and recurring bank deposits provide external validation that at least short-term profitability is being realized by many users.

From a financial modeling perspective, such high returns are unlikely to be uniform or permanent. More conservative investors should treat these figures as potential outcomes under ideal conditions rather than guaranteed results.

Risk Profile and Regulatory Context

Arvith benefits from government support, which significantly alters its risk profile. While it is not an officially regulated fund in the sense of SEBI mutual funds or RBI-sanctioned banking products, its alignment with government initiatives provides a degree of oversight and reduces the probability of fraudulent intent.

The system also avoids several common red flags: there is no use of unregulated cryptocurrencies, no pressure to recruit others, and no opaque profit structures. Additionally, the founders are Indian entrepreneurs with public affiliations, not anonymous figures operating from abroad.

For investors, this translates to a moderate-risk, high-reward scenario. The presence of structured automation and domestic banking integration makes Arvith more stable than peer systems operating outside regulatory purview.

Bottom Line: A Serious Contender in Digital Wealth Automation

Arvith offers a unique proposition: automated, daily-profit investing supported by local talent and government vision. It stands apart from many tools in the Indian market by reducing user input, maintaining transparency in transfers, and demonstrating rapid scale.

However, potential investors should approach the system with measured expectations. While the success stories are notable, they should be viewed as exceptional rather than normative. As with any financial product promising high returns, risk management and responsible investing remain essential.

In summary, Arvith is not a shortcut to wealth, but it may be a legitimate and well-constructed vehicle for wealth acceleration. It earns a place on the watchlist of anyone serious about modern, automated financial systems within the Indian context.